IRS Liens – No Amount is Too Small

Call Now – Free Consultation 866-477-5291

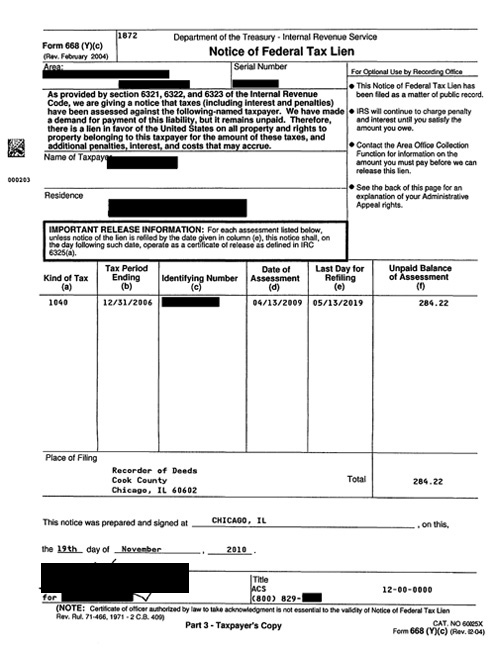

Do you need a tax lawyer? If you don’t think the IRS is going to come after you for a tax debt, just look at the notice below and see where the IRS is pursuing a taxpayer for only $284.22. Times are tough and the IRS is getting tougher.

Department of the Treasury – Internal Revenue Service

Notice of Federal Tax Lien

1872

Form 668 (Y)(c)

(Rev. February 2004)

Area: XXXXXXXXXXXXXXXXXXXXXX

As provided by section 6321, 6322, and 6323 of the Internal Revenue been filed as a matter of public record.

Code, we are giving a notice that taxes (including interest and penalties)

have been assessed against the following-named taxpayer. We have made • IRS will continue to charge penalty

a demand for payment of this liability, but it remains unpaid. Therefore, and interest until you satisfy the

there is a lien in favor of the United States on all property and rights to amount you owe.

property belonging to this taxpayer for the amount of these taxes, and

additional penalties, interest, and costs that may accrue. • Contact the Area Office Collection

Name of Taxpayer:

XXXXXXXXXXXXXXXXXXXXXXXX

Residence:

XXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXX, XX XXXXX-XXXX

IMPORTANT RELEASE INFORMATION: For each assessment listed below,

unless notice of the lien is refiled by the date given in column (e), this notice shall, on

the day following such date, operate as a certificate of release as defined in IRC

6325(a).

| Kind of Tax (a) |

Tax Period Ending (b) |

Identifying Number (C) |

Date of Assessment (d) |

Last Day for Refiling (e) |

Unpaid Balance of Assessment (f) |

|---|---|---|---|---|---|

| 1040 | 12/31/2006 | XXX-XX-XXXX | 04/13/2009 | 05/13/2019 | 284.22 |

Place of Filing

Recorder of Deeds

Cook County Total

Chicago, IL 60602

on this, the 19th day of November 2010.

Title ACS 12-00-0000

for XXXXXXXXXXXXX (800) 829-XXXX

(NOTE: Certificate of officer authorized by law to take acknowledgment is not essential to the validity of Notice of Federal Tax Lien

Rev. Ru!. 71-466, 1971 – 2 C.B. 409)

Part 3 – Taxpayer’s Copy CAT. NO 60025X

Form 668 (Y)(c) (Rev. 02-04)

| Lien This Notice of Federal Tax Lien gives public notice that the government has a lien on all your property (such as your house or car), all your rights to property (such as money owed to you) and to property you acquire after this lien is filed. Your Administrative Appeal Rights If you believe the IRS filed this Notice of Federal Tax Lien in error, you may appeal if any of the following conditions apply: • You had paid all tax, penalty and interest before the lien was filed; • IRS assessed tax after the date you filed a petition for bankruptcy; • IRS mailed your notice of deficiency to the wrong address; You have already filed a timely petition with the Tax Court; The statute of limitations for collection ended before IRS filed the notice of lien. Your appeal request must be in writing and contain the following: • Your name, current address and SSN/EIN; • Copy of this notice of lien, if available; • The specific reason(s) why you think the IRS is in error; • Proof that you paid the amount due (such as cancelled check); • Proof that you filed a bankruptcy petition before this lien was filed. Send your written request to the IRS, Attention: Technical Services Group Manager, in the office where this notice of lien was filed. When This Lien Can Be Released The IRS will issue a Certificate of Release of Federal Tax Lien within 30 days after: • You pay the tax due, including penalties, interest, and any other additions under law, or fRS adjusts the amount due, or; • The end of the time period during which we can collect the tax (usually 10 years). Publication 1450, Request for Release of Federal Tax Lien, availc.ble at IRS offices, describes this proces~. When a Lien against Property can be Removed The IRS may remove the lien from a specific piece of property if any of the following conditions apply: • You have other property subject to this lien that is worth at least two times the total of the tax you owe, including penalties and interest, plus the amount of any other debts you owe on the property (such as a mortgage); • You give up ownership in the property and IRS receives the value of the government’s interest in the property; • IRS decides the government’s interest in the property has no value when you give up ownership; • The property in question is being sold; there is a dispute about who is entitled to the sale proceeds; and the proceeds are placed in escrow while the dispute is being resolved. Publication 783, Instructions on How to Apply for a Certificate of Discharge of Property from a Federal Tax Lien, available at IRS offices, describes this process. |

Gravamen Este Aviso de Gravamen del Impuesto Federal da aviso publico que el gobiemo tiene un gravamen en todas sus propiedades (tal como su casa 0 carro), todos sus derechos a propiedad (taJes como el dinero que Ie adeudan a usted) y la propiedad que adquiera despues que se present6 este gravamen. Sus Derechos de Apelacion Administrativos Si usted cree que el IRS present6 este Aviso de Gravamen del Impuesto Federal por error, usted puede apelar si cualQuiera de las siguientes condiciones Ie aplican: • Usted pago todo el impuesto, multa, interes antes de que el gravamen fuera presentado; • EI IRS taso el impuesto despues della fecha en que usted presento una peticion de quiebra; • EI IRS Ie envio por correo el aviso de deficiencia a una direcci6n incorrecta; • Usted presento a tiempo una peticion ante la Corte de Impuesto; • EIIRS no present6 el aviso de gravamen dentro del termino prescriptivo. Su petici6n de apelacion Ilene que estar par escrito y debe incluir 10 slguiente: • Su nombre, direccion actual y SSN/EIN; • Una copia de este aviso de gravamen, si esta disponible; • La razon (0 razones) especifica(s) por que piensa que ellRS esta err6neo; • Prueba que pago la cantidad adeudada (tal como un cheque cancelado); • Prueba que present6 una peticion de quiebra antes de que se presentara el gravamen. Envie su peticion PEr escrito allRS, Atenci6n: “Technical Services Group Manager” (Grupe de Gerente-Servicios Tecnicos) en la oficina donde este aviso de gravamen fue presentado. Cuando Este Gravamen Se Puede Cancelar EI IRS emitira un Certificado de Cancelacion de Gravamen del Impuesto Federal dentro de 30 dias despues que: • Usted paga el impuesto adeudado, incluyendo multas, intereses, y otras sumas adicionales segun la ley, 0 el IRS ajusta la cantidad adeudada, 0; • Aceptemos una fianza garantizando el pago de su deuda; • La expiracion del termino en que podemos cobrar el impuesto (usualmente 10 anos). La Publicacion 1450, en ingles, “Petici6n Para Cancelar el Gravamen dellmpuesto Federal”, describe este proceso y esta disponib\e en las oficinas del IRS. Cuando un Gravamen en Contra de la Propiedad Puede Eliminarse EI IRS puede eliminar el gravamen de una propiedad especifica si cualquiera de las siguientes condiciones aplica: • Usted tiene otra propiedad sujeta a este gravamen cuyo valor es por 10 menos dos veces el total del impuesto que usted adeuda, Jncluyendo intereses y multas, mas la cantidad de cualquiera de las otras deudas que adeuda sobre la propiedad (tal como una hipoteca); • Usted cede su interes en la propiedad y eJ IRS recibe el valor del interes del gobiemo en la propiedad; • EI IRS decide que el interes del gobiemo en la propiedad no tiene valor alguno cuando usted cedi6 su interes en la propiedad; • La propiedad gravada sera vendida; existe una controversia sobre quien tiene derecho al producto de la venta; y se depositan los fondos recibidos en la venta en una cuenta especial en 10 que se resuelve la controversia. La Publicacion 783 en ingles, “Instrucciones de C6mo Solicitar un Certificado de Relevo de la Propiedad de un Gravamen dellmpuesto Federal”, describe este proceso y esta disponible en las oficinas del IRS. |

| Form 668 (Y) (c) (Rev. 02-2004) | |